Market experts have recently delved into XRP’s price trajectory, highlighting its unique patterns within crypto market cycles. Despite Bitcoin and Ethereum’s notable gains this year, XRP has experienced a downturn, sparking discussions about its potential for growth.

In each market cycle, XRP undergoes distinctive phases, often determined by the crossover of its 21 and 55 moving averages (MA) on a 2-week timeframe. These crossovers serve as significant indicators of upcoming bullish or bearish trends.

#XRP This Time Is Different – 9th of September 2024

— EGRAG CRYPTO (@egragcrypto) May 5, 2024

🔍 Examining the behavior of the 21 EMA and 55 MA on the 2-weekly timeframe.

📊 Definitions:#Bearish Cross: 55 MA crosses 21 EMA#Bullish Cross: 21 EMA crosses 55 MA

🔄 Cycle A:#Bearish cross to #Bullish cross: 574 days… pic.twitter.com/pa49S7NiSZ

Cycle A and B: Setting The Stage

In Cycle A, starting in 2016, the 21 MA dipped below the 55 MA, marking a 574-day bearish trend. Following this, a bullish crossover led XRP to its peak of $3.84 after 294 days. Cycle B, which began in Q1 2019, saw a similar pattern, with a 658-day bearish phase after the 21 MA crossed below the 55 MA. After the bullish crossover, XRP consolidated for 140 days before reaching its cycle peak of $1.96 in April 2021.

Related article: XRP Breakout Signal Unveiled by Analyst Amidst Historical Bollinger Bands Tightening

XRP is currently navigating Cycle C, which commenced in the latter half of the previous year when the 21 MA fell below the 55 MA. This transition has led to XRP’s subdued performance since August 2023. Despite the subsequent bullish crossover, XRP has remained in consolidation for 154 days without reaching its peak for this cycle.

Related article: XRP Transfer Sparks Speculation Amidst Legal Battle

Drawing parallels with Cycle A, the analyst predicts that XRP’s peak in Cycle C could be imminent. If XRP follows a similar trajectory, it may reach its cycle peak in the next 140 days. Consequently, it could potentially hit $3.84 by September 9.

Bullish Sentiments and Market Dynamics

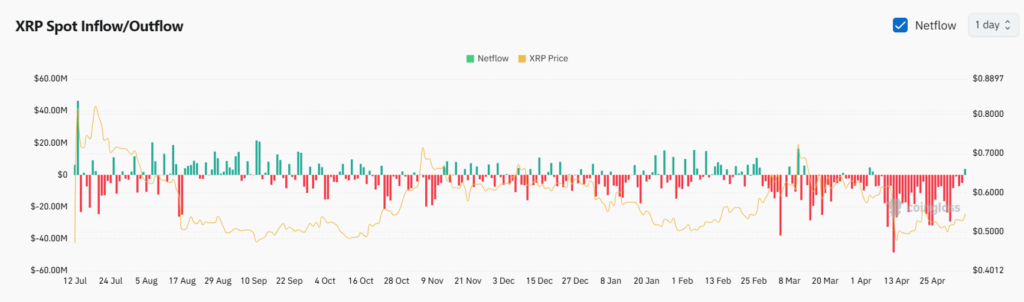

Recent data from Coinglass shows a surge in bullish sentiments on XRP. Open interest rose by 6% to $580 million, with a long/short ratio of 1.0657, indicating increasing bets on XRP’s short-term price surge. Investors withdrew over $477 million worth of XRP from exchanges since April 6, signaling a move towards long-term storage. On April 12, a significant withdrawal of over $48 million marked the highest negative netflow this year.

XRP Exchange Netflow | Coinglass

As of now, XRP is trading at $0.5462, marking a 9.15% increase for the month. The cryptocurrency is hovering around the 20-day exponential moving average (EMA) at $0.5488 on the monthly timeframe, poised for potential gains if it breaks above this level.

We're on Twitter, follow us to connect with us: @Cryptoboom

— Cryptoboom (@Cryptoboom29884) April 15, 2024

Market analysts foresee a bullish outlook for XRP, drawing parallels with historical cycles and observing positive market dynamics. With increasing bullish sentiments and a potential peak in Cycle C on the horizon, investors and traders are closely monitoring XRP’s price movements in anticipation of further gains.